Strategy

Trade with the trend

Trents last weeks and months, not days and hours.

Let the Market come to you

Wait for EMA mean reversion.

Patience wins trades

90% of the time price moves slowly.

Winning Rules

- Trade Infrequently.

- Trade when the volume is low.

- Only use limit orders.

- Manage risk with 3:1 RR + (at least 2:1).

- Take 25% ASAP (50% on 2:1 RR).

- Never change your plan once a position is open.

- Place stop-loss with stop-hunters in mind and never at round or significant numbers.

Step 1

Long Term Trend identification.

The predominent trend can be identified by:

- Which array of moves have the sharpest inclines or declines? The sharpest moves (irrespective of channel) determine if the trend is bullish or bearish. In other words, the moves that take the shortest time to complete (with the greatest volatility/price/percentage change) determines the strength in that direction. Often the opposite is true on small timeframes, which is how most traders (myself included!) die from a thousand cuts.

- Is the activity predominently above or below the EMA ribbon on longer timeframes?

- If above, look to long the dips

- If below, look to short the pumps.

What to Look for When Going Long?

- Bullish macro trend.

- Asset is bullish.

- Critical areas of support.

- Bullish divergence (MacD,RSI, ideally both).

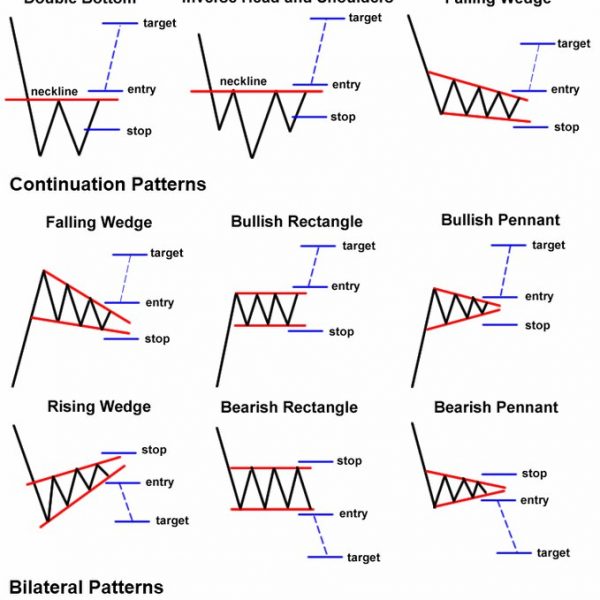

- Bullish pattern (Falling Wedge/Ascending Triangle).

- Receding volume.

- The Same across several time frames (1hr, 4hr, daily, weekly).

The market can remain irrational longer than one can remain solvent.

Balls Out

- Ensure that the Limit order set is in the upper or lower region of the trading channel, depending on the trading direction. Upper end of the channel if going short and lower end if going long.

- The closer to the support/resistance zone you are entering, the smaller the trade’s risk becomes, if that particular zone breaks.

- DCA the high/low range to spread the entry with limit orders on the other end of the support/resistance zone to catch the extremes.

- Set a conditional Market order to close the trade on the other side, in case the support/resistance zone fails.

Set Targets

- Look for next level support/resistance levels.

- Look for fib extension levels.

- Look for EMAs.

- Confluence of all 3.

Enter the market when tame. Take profits when wild.

Step 2

Make the trade

- RSI divergence will indicate price reversal / mean reversion.

- MacD diversion (and other oscillators) will add validity to RSI divergence.

- Volume should be in in decline.

- Patterns can be useful for breakout trades.

Banana Split indicator will provide stronger divergence signals because it is based on moving averages and divergence between price movement and money flow (showing where the most money is selling and where selling has exhausted).

Entry

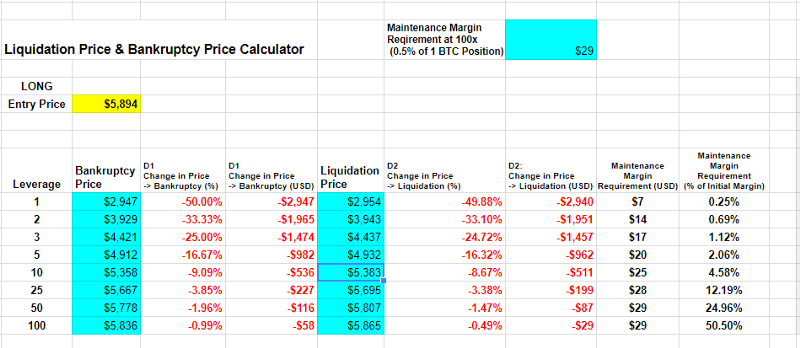

- Plan your play using the Anti-Liquidation tool first

- Set limit order at a key support/resistance level.

- Set Market Stop-Loss >= 1.6% away from entry (or Conditional Market order >= 5% away).

In-Trade

- Once open, set Take Profits:

1 of 3 – Take Profit Limit = 33% of contracts @ 1.618 fib extension.

2 of 3 – Take Profit Market = 33% of contracts @ 2 fib extension.

3 of 3 – Trailing Stop = 33% of contracts @ [1.618 fib extension price change value x 0.618). - If market looks uncertain, close 50% of contracts (if breaking below previous low [or above previous high]).

Step 3

DCA the Trend

- To DCA, wait for higher low (or lower high) with oscillator convergence to increase position to 10% of purse.

- Adjust stoploss and add a Take Profit below new low.

In traditional markets

In a bull market, amateurs take profits at opening on Monday – Price tends to close at highs on Friday